How INCOTERMS Affect Your Business

01 August 2024When it comes to international trade, understanding the rules and terms that govern the exchange of goods is essential for a successful and seamless transaction. One set of rules that holds significant importance in global trade is the International Commercial Terms, better known as INCOTERMS. In this article, we’ll demystify INCOTERMS, explain why they’re crucial, provide examples of important INCOTERMS, and explore how they can impact your business. So, let’s dive in!

What are INCOTERMS?

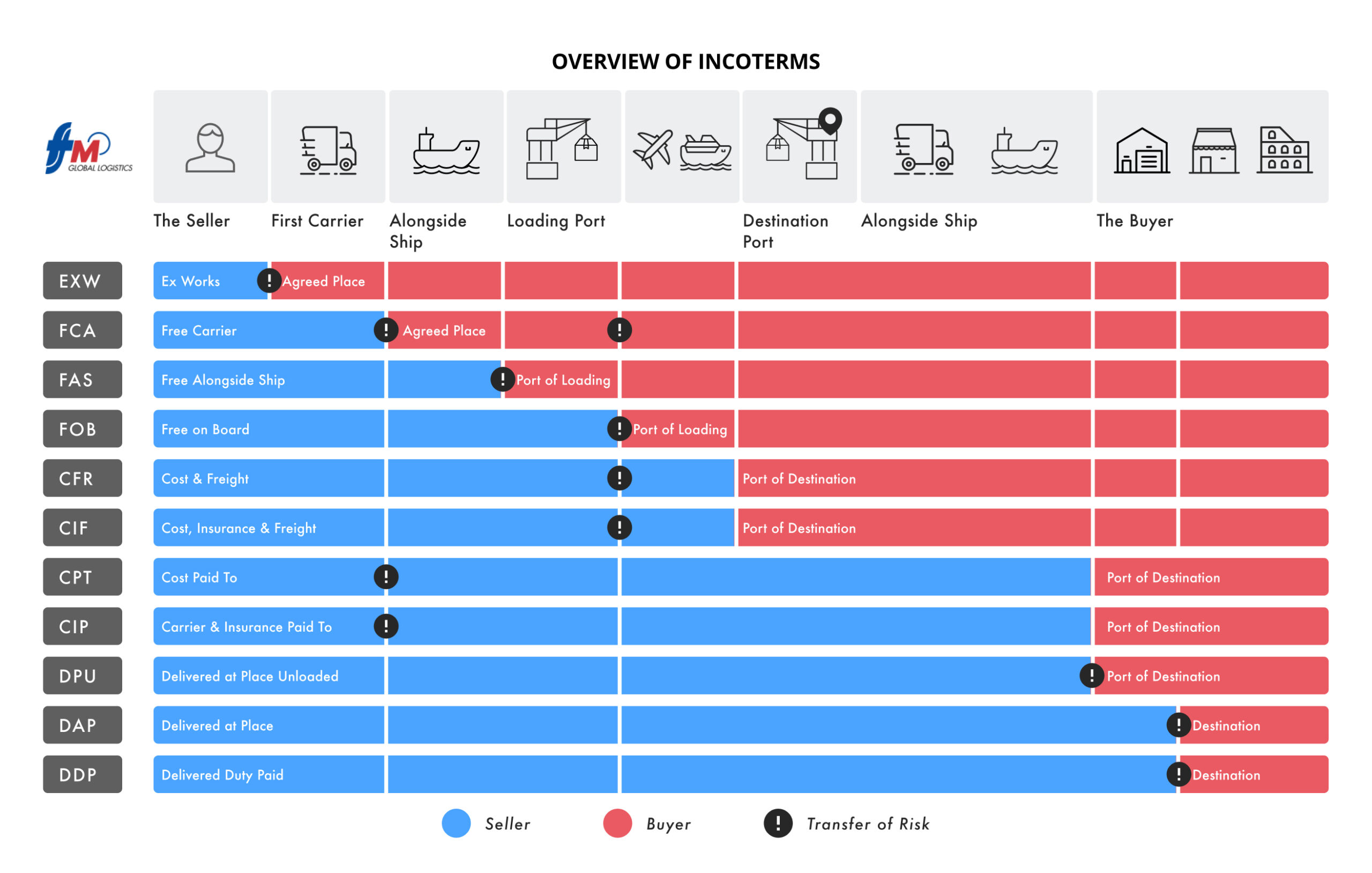

At their core, INCOTERMS are a standardized set of rules published by the International Chamber of Commerce (ICC) that define the responsibilities and obligations of buyers and sellers in international trade. They serve as a common language for businesses worldwide, facilitating communication, reducing disputes, and ensuring clarity during negotiations.

INCOTERMS establish who is responsible for tasks such as transportation, insurance, customs clearance, and the transfer of risks and costs.

Why are INCOTERMS important?

INCOTERMS play a vital role in international trade for several reasons. Firstly, they help minimize misunderstandings and conflicts between buyers and sellers by establishing clear guidelines. By clearly outlining the rights and responsibilities of each party, INCOTERMS provide a framework that prevents ambiguity and ensures a smooth transaction.

Secondly, INCOTERMS determine the allocation of costs and risks. For instance, they clarify who is responsible for arranging and paying for transportation, import/export duties, and insurance. This clarity helps businesses plan their finances effectively and reduces the potential for unexpected expenses or disputes.

Examples of Important INCOTERMS:

Let’s take a look at a few commonly used and important INCOTERMS:

- EXW (Ex Works): Under EXW, the seller’s responsibility ends when they make the goods available at their premises or another agreed-upon location. The buyer assumes all risks and costs from that point onwards, including transportation, customs clearance, and insurance.

- FCA (Free Carrier): FCA stipulates that the seller covers charges and arrangements up to the moment that the freight arrives at the named place of destination as stipulated by the buyer. These charges include freight packaging, loading charges, delivery to port/place and export duties/taxes.(Note that ‘free’ within this INCOTERM and the next two refers to the supplier’s obligation to deliver goods to a specific location, later to be transferred to a carrier. In other words, the supplier is “free” of responsibility.)

- FAS (Free Alongside Ship): FAS signifies that the seller must arrange for export documentation and deliver the goods to the port. From there, the buyer will hire the shipment, arrange to load and import the goods.

- FOB (Free on Board): FOB requires the seller to deliver the goods onto a vessel at the named port of shipment. Once the goods are on board, the buyer assumes responsibility for transportation, insurance, and any potential risks.

- CFR (Cost and Freight): CFR means that once the goods reach its final destination, it becomes the responsibility of the buyer. The buyer is to arrange unloading, pay customs fees and arrange documents and transport to the goods’ final destination.

- CIF (Cost, Insurance, and Freight): CIF places the onus on the seller to arrange and pay for transportation to the port of destination, as well as the cost of insurance. However, once the goods are loaded onto the vessel, the buyer assumes responsibility for any risks and import-related costs.

- CPT (Carriage Paid To): CPT, when applied to an international contract, requires the seller to handle payments and arrangements associated with transporting goods until it reaches its destination terminal facility.

- CIP (Carriage and Insurance Paid To): CIP is similar in nature to CPT, except that the seller additionally handles insurance costs for the freight until it has reached its final destination.

- DAP (Delivered At Place): DAP, when utilised, means that the responsibilities of the buyer are to pay only for the import duties, taxes and fee of the product, as well as arrange to unload goods at the point of destination. Everything else is handled by the seller.

- DPU (Delivered At Place Unloaded): DPU means that the seller is responsible for the unloading of the goods at the place specified by the buyer. The buyer only needs to pay for the customs fees and taxes.

- DDP (Delivered Duty Paid): DDP represents the maximum level of responsibility for the seller. The seller is responsible for delivering the goods to the named place of destination, handling all tasks, including transportation, customs clearance, and payment of import duties and taxes.

How Do INCOTERMS Affect Your Business?

Understanding and selecting the appropriate INCOTERM can have a significant impact on your operations and bottom line.

- Cost Considerations: Choosing the right INCOTERM can influence your pricing strategy and overall profitability. For example, if you take on more responsibilities and costs, you may need to account for these factors when setting your prices. On the other hand, opting for an INCOTERM that places more obligations on the buyer could affect your competitiveness in the market.

- Risk Management: INCOTERMS help define the transfer of risks from the seller to the buyer. By selecting the appropriate INCOTERM, you can allocate risks effectively and ensure that your business is protected. Understanding who bears the responsibility in case of loss, damage, or theft of goods allows you to make informed decisions regarding insurance coverage and risk mitigation strategies.

- Supply Chain Efficiency: The choice of INCOTERM can impact the efficiency of your supply chain. For instance, selecting an INCOTERM that requires the seller to handle customs clearance may be advantageous if you have expertise and resources in that area. Conversely, if your strengths lie in other aspects of the supply chain, it may be more beneficial to choose an INCOTERM that places those responsibilities on the buyer or a third party.

Conclusion

INCOTERMS serve as a critical tool in international trade, ensuring clarity, reducing disputes, and enabling smooth transactions between buyers and sellers. By understanding the responsibilities, risks, and costs associated with different INCOTERMS, you can make informed decisions that align with your business goals and requirements.

It’s important to remember to consult with your trade partners or logistics providers to prepare to navigate the complexities of international trade with confidence and foster successful business relationships, whether globally or locally.

If you’re looking to streamline your international trade operations and optimize your use of INCOTERMS, reach out to us at FM Global Logistics today to explore how our expertise can help your business thrive in the global marketplace and unlock its full potential.